What is Leverage in Trading?

Articles

Electronic trading in financial markets is an unpredictable adventure full of ups and downs, where sometimes every second is worth its weight in gold. Despite the great opportunities to make money in trading financial assets, some traders and investors, especially beginners, stick to the simple strategy of buying an asset at the bottom and then selling it at the highest possible price. Nevertheless, there is a trading mode, allowing multiplying the investments, using borrowed funds of the broker or stock exchange. This mode is called leverage trading or most commonly – margin trading.

What is Leverage in Trading?

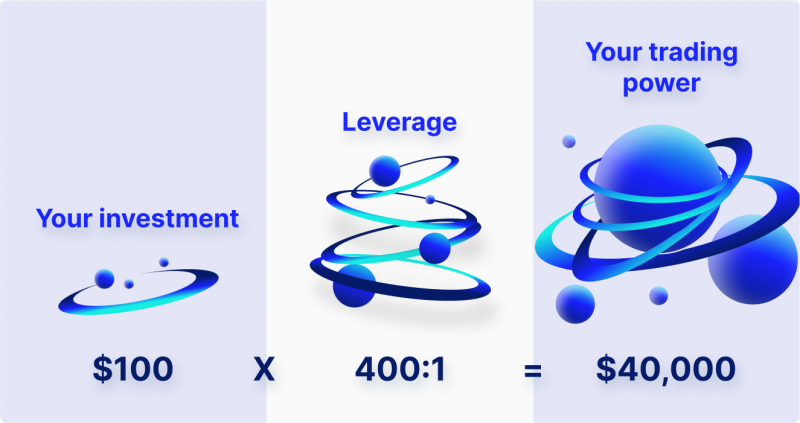

Leverage is a sophisticated and risky financial instrument that operates on mathematical models, enabling traders to vary their deposit size according to the price of an asset, its purchase volume, as well as margin regime.

Leverage trading (sometimes “leveraged trading”) is the process of buying (long) or selling (short) financial assets using borrowed funds from an exchange or broker that is being traded at a specific rate set individually by each trading platform.

Leverage trading is similar to taking credit from a bank. Thus, by buying a car with credit money, the transport acts as a collateral. If the borrower fails to perform his financial obligations to the bank, the debt will be repaid at the expense of the pledged asset. When trading on margin, the collateral is the money or securities on users’ balance.

Leveraged trading usually implies that in order for traders to be able to borrow additional capital to increase the volume of a position, they need to put up a small amount of their own capital as collateral which is called a margin. In other words, in order to take advantage of the leverage of a trading platform in any financial market, they first need to have a certain minimum amount on their deposit, which also varies greatly depending on the trading platform.

Speaking of the stock exchange, for example, it is allowed to open a leveraged position only on the most traded (liquid) securities. It is also allowed to trade units of exchange-traded funds, currencies or derivatives (futures contracts). Each brokerage firm draws up its own register of assets for “lending.”

Leveraged trading allows opening long and short trades. In the case of the cryptocurrency market, almost all cryptocurrency exchanges allow opening leveraged trades on all available assets, with the only difference being that the amount of leverage available will vary. Trading with leverage is special in the foreign exchange market because its ratio is predetermined by algorithms and is not subject to regulation.

Leverage ratio is calculated according to the leverage ratio formula as the ratio of total debt to total equity.

Leverage Ratios in the Financial Markets

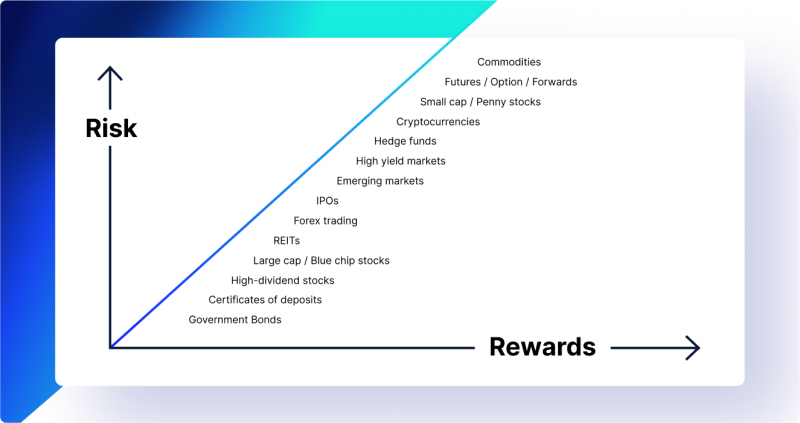

Today, there are many different financial markets that offer the opportunity to use the mode of margin trading with leverage. Among the most popular markets are the stock market where stocks, bonds, indices, and other financial instruments are traded, the Forex markets and the crypto market. However, the level of maximum leverage ratio in each of these markets is very different.

Stock Market

Stock trading is famous for its variety of financial instruments that are available for trading. The list of the most popular assets includes stocks, bonds, currencies, metals, funds, options, and futures. In this case choosing an asset for margin trading, the leverage ratio is not a fixed value, like in the Forex market for example, but it is a ratio calculated according to the risk rate, taking into account the initial trading capital amount and risk evaluation of a trading instrument for both long and short trading. Therefore, the leverage ratio is an indicator that is calculated based on the liquidity of each individual financial instrument and is known at the stage of its purchase.

Forex Market

Leverage ratio varies with each Forex broker depending on the instrument traded, but in most cases the standard leverage size for currencies trading varies from 1:25 to 1:1000, which means that for each $1 of your money you can get from 25 to 1000 borrowed funds. It helps to increase the initial capital many times over and achieve incredible profits if you use a good strategy.

The possibility of such high leverage is due to the fact that for private investors, Forex is the market without delivery of the underlying asset. Traders don’t buy euros for dollars because they need euros – it can be done at an exchange office or on the foreign exchange market. They bet on the growth or fall of the underlying asset, which in this case is the currency against the quoted currency. And to do that they do not need to have enough money in their trading account to buy out the whole volume of currency they operate with – it’s enough to have a collateral, and the rest is covered by the broker’s credit line.

Cryptocurrency Market

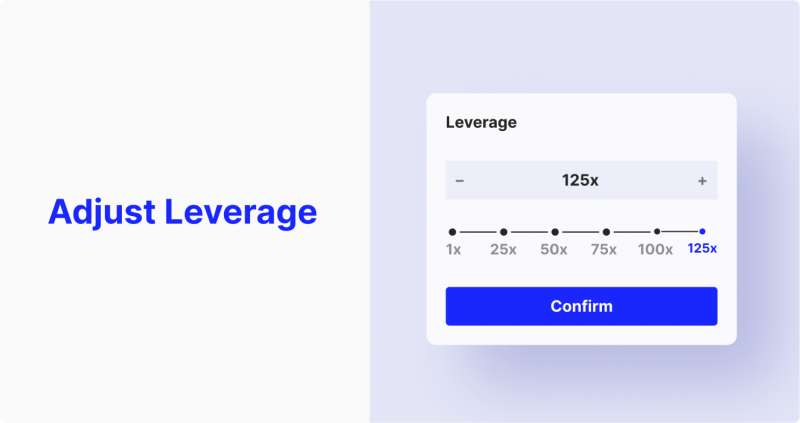

On the crypto-market the value of leverage is denoted as a ratio, for example 1:5 (5x), 1:10 (10x) or 1:50 (50x), which shows how many times the initial capital increases in relation to the initial deposit. Working with the majority of instruments, exchanges allow the use of leverage in the range of 25-75x, but particularly liquid assets such as Bitcoin have a leverage size of 125x, which is the highest level among all traded assets.

Leverage in trading is an extremely risky tool, so traders must be careful working with it. It is necessary to take into account many factors, among which is the liquidation of the trading position in the case when the trading account of the trader is not enough margin to maintain its open position, whether long or short, which is also known as “margin call”. A margin call is a signal that the trader’s deposit is depleted and must be replenished with additional funds.

Growth of Quotes

Firstly, it is necessary to take into account the possibility of growth of quotations during trading on decline and vice versa. Receiving borrowed funds, the trader increases the number of open transactions, which accordingly increases the potential losses. Often this aspect is not taken into consideration by newbies who are chasing easy money.

Margin Call

Let’s turn to a very well-known concept when it comes to trading with leverage – margin call. This is a request from the broker to the trader to deposit onto his account because the margin on his account is close to zero. It appears when, in case of an incorrect forecast, the trader’s loss increases as the asset price moves in the opposite direction. Accordingly, sooner or later (assuming that the trader has yet to insure the position with a stop order), the moment will come when the trader has almost no money left. At this time, the broker, in order not to lose his money, requests the trader to deposit to his account. If this does not happen, the transaction will be closed when the trading account balance reaches 0. It is also worth noting that most traders receive a margin call due to the high volatility of the market.

Leverage Operation Principle

When it comes to leveraged trading, the amount of leverage and the risk limit of the trading platform are directly related. So, if the leverage size is 1:2, then the broker or exchange will wait until the loss reaches 50%. However, if the ratio is 1:3, then the trading platform will sell the assets already when the quotes are down 33%.

Cost

Thirdly, leverage is a paid service and, depending on the financial market and also on the broker with whom you trade, the price for this service may vary. The exception is transactions made on the day the loan is made, if it is the stock market. In this case, if the position remains open the next day, you have to pay a commission in the form of interest for each day the position remains open.

Regardless of what market you trade in and what your strategy is, you must remember that the size of leverage directly affects not only the potential profit you can make, but also the potential loss you can incur. Before dealing with margin trading and increasing the leverage size, you need to learn how to trade in spot mode, which has much lower risks compared to, for example, futures in case we are talking about the crypto market, or to try trading on a demo account if we are talking about the Forex market.

How is the Leverage Size Determined?

Leverage is a popular tool among traders who are not afraid to take risks in the pursuit of large profits. However, in order to understand how much leverage you can have, it’s required to know that the value of leverage is calculated based on several factors, which are listed below.

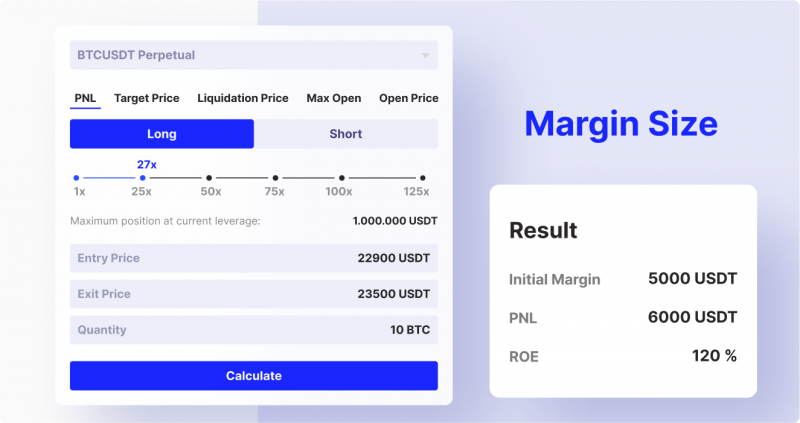

Margin Size

Indicators such as this are calculated by the broker for each leveraged trade submitted by a client. In calculating margin, the value of assets held on the account of the investor is added up, with only the most liquid assets included: money and securities that are the easiest to sell, which are published by each broker online.

The margin increases or decreases in direct proportion to the increase or decrease in profits and losses. Brokers ensure, however, that the margin does not fall below the minimum amount necessary to ensure that the client will be able to repay the loan.

According to the following formula, the broker determines the maximum amount of a margin loan: Divide the margin by the instrument discount, then subtract the amount of the investor’s own funds.

Trader Risk Level

Leveraged trading has a different level of risk depending on the risk score of the trader.

As a rule, the level of a trader’s risk is determined by the broker or the exchange on which he trades. The leverage size the broker is ready to give the trader is determined based on many indicators, among which is the market’s volatility.

The risk level is a numeric value in the range from 0 to 10, where the value of 10 corresponds to an extremely high and 0 – to an extremely low risk. These figures are not arbitrary and are based on scrupulous calculations. However, it should be clarified that every broker has its own scale of values for this indicator. For example, on many cryptocurrency exchanges, this index is calculated from 0 to 999, where the higher the number, the lower the risk.

Market Volatility

Volatility of the market is quite a typical phenomenon, which mainly occurs in the crypto market. High fluctuations of assets against the background of various kinds of news create a high risk of losing trading capital, especially if the trader does not use methods of hedging it by setting stop loss. Given this, many brokers limit access to high leverage during periods of high market volatility. Also, this measure often serves as a protective mechanism to limit access to leverage trading for traders who have no experience in trading.

Thus, the assessment of leverage that can be used by a trader is a complex process that takes into account many parameters for the optimal correlation between the level of risk and the amount of available trader’s start-up capital.

Conclusion

Leverage is an excellent tool for increasing potential profits, which is very popular among professional traders. Large leverage in most financial markets allows you to get more freedom with limited starting capital. However, on the other hand, regardless of the level of leverage used, you should always remember about the risks that are equal in equal proportion to the potential profit that the trader seeks to receive. Using a good trading strategy, money and risk management will help you achieve excellent results when trading any asset, especially the most liquid ones.

FAQ

What is the leverage traders meaning in financial markets?

The leverage traders meaning refers to the use of borrowed funds to increase the potential return of an investment. By using leverage, traders can control larger positions with a smaller amount of their own capital, amplifying both potential gains and losses.

How is trade leverage defined in trading?

Trade leverage is defined as the ratio of the trader’s own funds to the borrowed funds provided by a broker or exchange. It allows traders to multiply their trading power, enabling them to execute larger trades than their initial capital would otherwise permit.

What are the risks associated with using leverage in trading?

Using leverage in trading increases the potential for higher profits but also amplifies the risks of significant losses. Traders must manage their risk carefully, as leverage can lead to margin calls or liquidation of positions if the market moves against them.